According to the Swedish Tax Agency, staff ledgers must be kept for two years after the end of the calendar year in which your tax year ended.

This means that all information registered in the staff ledger must be accessible and in good condition during this time. The Swedish Tax Agency may request the staff ledger during this period.

The staff ledger contains information about which individuals have been active at the workplace, their working hours, and other relevant details. This information must be kept to ensure that the company complies with applicable regulations and can present correct documentation during a potential audit. Therefore, it’s important that companies not only record this information correctly but also store it securely throughout the entire statutory period.

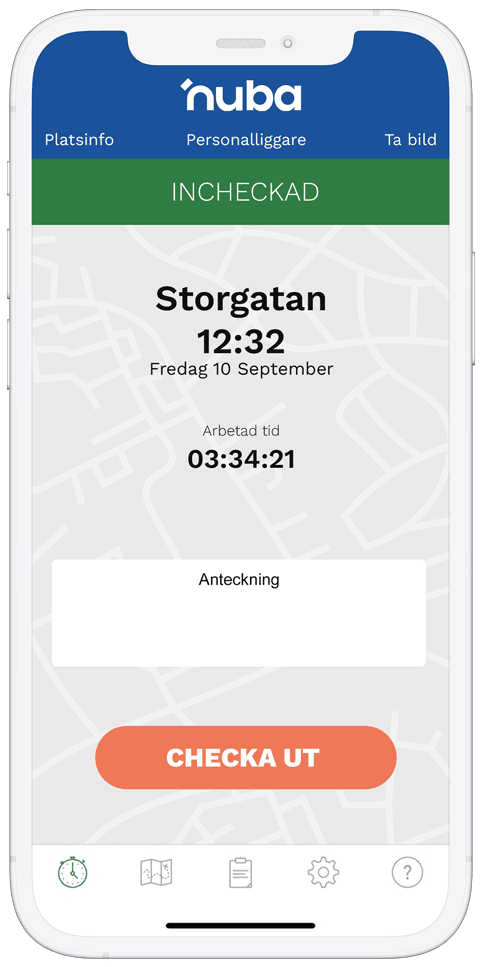

In Nuba’s staff ledger app, information is conveniently stored digitally, eliminating the need to keep track of paper records. Additionally, the information is readily available if the Swedish Tax Agency requests it.

Legally Required to be Kept for Two Years

By law, companies are required to keep staff ledgers for two years. This requirement applies regardless of whether the staff ledger is in paper form or if the company uses an electronic staff ledger. Keeping staff ledgers for two years allows the Swedish Tax Agency to conduct post-audit checks to ensure all legal requirements have been met during the relevant period.

During these two years, the staff ledger must be available for inspection at any time if the Swedish Tax Agency conducts a control visit. If the company cannot present a correct and complete staff ledger going back two years, this may lead to sanctions or fines. Therefore, it’s important to have a systematic and reliable method for storing this information.

Nuba’s digital staff ledger offers an efficient solution to ensure all records are stored correctly and are accessible when needed. With an electronic staff ledger, it becomes easier to manage large amounts of data and ensure all information is secure and easily accessible throughout the entire storage period.

How the Staff Ledger Works

The staff ledger, whether electronic or manual, has the main purpose of recording and storing information about staff presence and working hours at the workplace. The system should be easy to use and adapted to handle the requirements set by law. A digital solution, like the one Nuba offers, simplifies the entire process by automating the registration and storage of this information.

With an electronic staff ledger from Nuba, staff arrival and departure are registered automatically, reducing the risk of human error and ensuring that the information is accurate and up-to-date. Additionally, the system makes it easier to comply with applicable laws and regulations, as it automatically saves all necessary information and keeps it available for potential review.

It’s also important to note that while records must be kept for at least two years, in some cases it may be appropriate to keep them longer, depending on the company’s specific needs and industry regulations. Nuba therefore offers flexible solutions that can be adapted to meet these requirements, giving companies peace of mind and confidence that they always have the right documentation at hand.

Benefits of Using an Electronic Staff Ledger

Using an electronic staff ledger has many advantages, especially when it comes to storing information securely and accessibly. With Nuba, it becomes easier to comply with the law as the system automatically handles registrations and storage. Companies don’t need to worry about losing or incorrectly archiving important information, which is a risk with manual systems.

Another major advantage is that an electronic staff ledger can be integrated with other systems the company uses, making it easier to manage all aspects of personnel administration in a coordinated and efficient way. This also means that companies can save time and resources by automating processes that would otherwise require manual work.

Last but not least, by using an electronic solution like Nuba, companies can quickly and easily fulfill their statutory obligations, reducing the risk of fines and other sanctions. With such a system, companies can feel confident that they are always prepared for a potential audit from the Swedish Tax Agency and that they comply with all applicable regulations.

Summary

Keeping staff ledger records for two years is a statutory requirement for companies in certain industries, and it’s important that this information is handled correctly and securely. By using an electronic staff ledger from Nuba, companies can simplify this process and ensure that all information is available and accurate when needed. It helps companies comply with the law, avoid sanctions, and ensure their operations are conducted in a correct and organized manner.