Companies in several industries are legally required to maintain a staff ledger . The purpose of using an electronic staff ledger is to prevent undeclared work and promote fair working conditions.

Restaurants, hair salons, construction companies, and laundries are examples of such businesses.

Industries Covered by the Regulations

The first category is the construction industry, including carpenters, painters, and other specialized craftsmen who perform work on construction sites and property maintenance.

The restaurant industry, from small cafes to large restaurant chains, is also required to keep a staff ledger. In this sector, the staff ledger is strictly regulated to ensure that all employees’ working hours and employment conditions are closely monitored.

Hair salons and other beauty salons, including spas and massage clinics, must also keep a detailed staff ledger. This ensures compliance with tax and labor legislation in these businesses as well.

Furthermore, laundries and cleaning companies are subject to the requirement. These companies must carefully document their employees’ working hours to maintain control and promote transparent working conditions.

By using a staff ledger app like Nuba, these companies can easily stay within the bounds of the law.

Construction Industry and Staff Ledger

The construction industry is one of the sectors covered by the staff ledger law and includes construction sites, renovations, and various types of property maintenance. The staff ledger is a critical part of ensuring that proper working conditions are maintained and that the employer complies with applicable rules and laws.

With a staff ledger app, like the one we at Nuba offer, construction companies can efficiently manage their personnel records while meeting the Swedish Tax Agency’s requirements in a smooth and digital manner.

Restaurant Businesses and Staff Ledger

Restaurant businesses play a crucial role in Sweden’s economy and have strict requirements for maintaining a staff ledger. The Swedish Tax Agency requires that all employees in a restaurant business are carefully registered, including permanent staff, extra personnel, and temporary workers.

With Nuba, which has an integrated staff ledger app, restaurant businesses can easily comply with the regulations. This system not only facilitates compliance but also improves the administration of personnel registration.

Hair and Beauty Salons

Hair and beauty salons are another industry covered by the staff ledger requirement according to the Swedish Tax Agency. This means that all employees, including freelancers and interns, must be properly registered. Using a staff ledger app like Nuba can significantly simplify this process. Nuba meets all rules and requirements from the Swedish Tax Agency and offers a smooth and efficient solution for keeping track of all registrations. With the help of Nuba, salon owners can focus on providing the best possible service to their customers while ensuring full compliance with statutory requirements.

Laundries and Staff Ledger

Laundries are also covered by the requirement to keep a staff ledger, a measure that ensures transparent employment conditions and counteracts undeclared work. By carefully recording working hours and personnel information through a time reporting system, laundries comply with the Swedish Tax Agency’s rules and contribute to a fairer labor market.

Implementing a digital solution like Nuba, with a built-in staff ledger via the app, can be especially beneficial for laundries. The app offers easy use and automatic data storage directly in the cloud, making it convenient to keep information updated and available for inspection. This way, laundries can focus on delivering high-quality services rather than worrying about administrative requirements.

Auto Repair Shops and Staff Ledger Requirements

Auto repair shops are subject to rules that require a carefully maintained staff ledger. This measure aims to prevent economic crime and ensure a fair work environment. Everyone working in the shop, including employees and hired staff, must be registered daily.

Nuba offers a user-friendly staff ledger app that smoothly meets these requirements. With automatic registration and cloud-based data storage, repair shops can optimize their processes and minimize administrative hassle.

Benefits of a Digital Staff Ledger via App

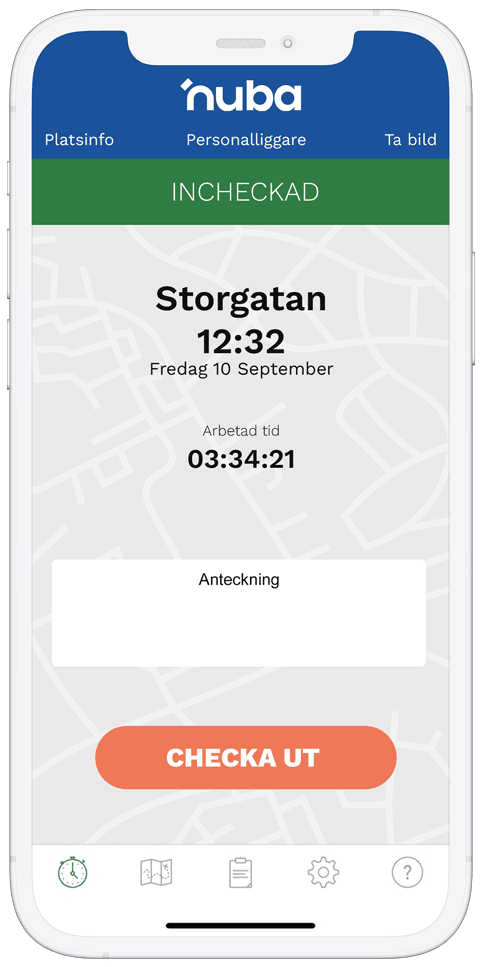

A digital staff ledger, such as Nuba, offers a superior solution for managing attendance and legal requirements.

The technology enables quick and efficient data collection across all types of businesses, from construction to the service industry.

Moreover, it reduces the risk of human error, as automation ensures that all information is recorded correctly and immediately stored in the cloud.

Digital tools like Nuba’s staff ledger app ensure that companies can easily follow the rules while optimizing their internal processes, creating a simplified and responsible work environment. It not only makes it easier for employers to keep track of attendance but also for employees to feel secure that their working hours are logged correctly and reliably.

Why Choose Nuba?

Nuba offers not only a user-friendly interface but also a tailored solution that meets the Swedish Tax Agency’s requirements. With Nuba, you get a staff ledger app that simplifies administration, saves time, and increases accuracy.

Additionally, Nuba ensures that all data is immediately stored securely in the cloud, further reducing the risk of data loss and facilitating compliance with legal requirements.

Swedish Tax Agency Approval

Using an electronic staff ledger via an app that meets the Swedish Tax Agency’s requirements is crucial for ensuring rules and compliance.

- Secure storage: All data is stored directly in the cloud, protecting against data loss.

- Automated registration: Automation reduces the risk of human error.

- Easy access: Documentation can be quickly and easily retrieved when needed, for example during inspections.

By using Nuba, companies can be confident that they are following the Swedish Tax Agency’s rules.

Nuba offers a complete solution with a staff ledger system that simplifies administration and meets all regulatory requirements.

Nuba’s Features

User-friendly App

All documentation is done and available directly in the app.

Whether your team is spread across multiple locations or working remotely, Nuba ensures that everyone is synchronized. The real-time updates that the app offers are invaluable for keeping track of workforce and workflows.

Nuba meets the Swedish Tax Agency’s requirements. This allows the company to focus on its core business instead of administrative details. The user-friendliness combined with robust features provides a great solution for personnel management.

Automatic Updates

One of the biggest advantages of Nuba is automatic registration of clock-ins and clock-outs.

With Nuba, all changes in personnel history and working hours are automatically updated and recorded in the system. This means you always have the most up-to-date information available, which is crucial for maintaining an efficient and smooth work process. It also reduces the risk of human errors and mistakes that often come with manual data entry.

How Nuba Helps your Company Comply with the Law

Nuba’s staff ledger app offers a well-thought-out and easy-to-manage solution for companies that want to ensure they comply with the law. Through automated processes, the app ensures that all necessary information is always up-to-date and correct, allowing your business to operate smoothly and legally.

Integrated Solutions for Various Industries

Nuba’s staff ledger app is tailored to suit a variety of industries, ensuring that every company can stay in compliance, which is crucial for success.

ID06 cards give the impression that they have the only staff ledger for the construction industry that the Swedish Tax Agency approves. This is not true. If you are looking for a much smoother solution and want to avoid unnecessary administration, Nuba is the right choice for you.

Running a restaurant often involves high staff turnover, making it critical to keep accurate staff ledgers. With Nuba’s app, this becomes easy and efficient, with real-time updates and automatic notifications.

Whether you work in beauty care, hair salons, or the cleaning industry, Nuba offers an adaptable and reliable solution. With integrations spanning across different sectors, you can feel secure and focus on developing your business.

Features such as automatic check-in and check-out, time clock, and automated reports satisfy both the entrepreneur’s and the Swedish Tax Agency’s requirements.