The construction industry, restaurant industry, hair and beauty industry, vehicle service, laundry industry, and food industry are required by Swedish law to keep a staff ledger.

By keeping a staff ledger, everyone working on-site is documented, helping to combat undeclared work, tax evasion, and poor employment agreements.

The Swedish Tax Agency regularly inspects certain workplaces, and the company must be able to quickly present its staff ledger containing all correct information.

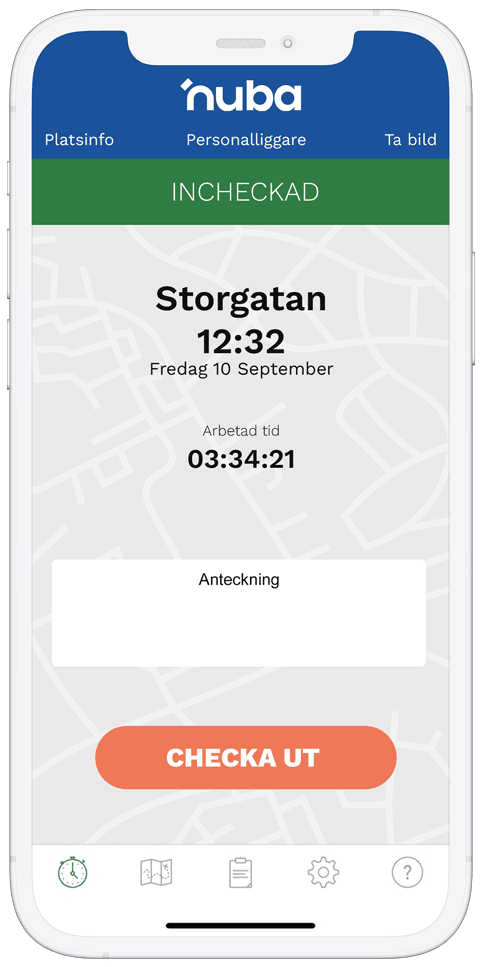

Nuba offers an electronic staff ledger via app, where all key data is recorded securely, accurately, and is easy to access.

An Electronic Staff Ledger Can be Used for Convenience

To help businesses comply with the law and reduce administrative work, an electronic staff ledger can be used. Electronic staff ledgers are not only easier to handle but also more reliable and less prone to errors compared to manual records. By using an electronic staff ledger from Nuba, companies can ensure that all details are accurate and that they meet legal requirements.

Nuba provides a solution where the staff ledger is recorded digitally, meaning the data can be kept up to date in real time and easily shared with the Swedish Tax Agency when needed. Electronic registration also means companies can reduce the time spent on administration and focus more on their core business.

Which Industries Must Keep a Staff Ledger?

A staff ledger can be useful for most businesses, but some are legally required to keep one.

Construction industry: Companies engaged in construction are among the most strictly regulated when it comes to staff ledger requirements. The developer must provide equipment to keep a staff ledger and ensure everyone working on the construction site is registered.

Restaurant industry: All businesses serving food and drinks are required to keep a staff ledger. This includes restaurants, cafés, and bars.

Hair and beauty industry: Salons offering hair care, beauty services, and similar must keep a staff ledger.

Laundry industry: Companies that provide dry cleaning and other laundry services must also keep a staff ledger.

Exemptions from the Rules

Despite the extensive requirements, there are some exemptions where companies do not need to keep a staff ledger. Smaller operations with fewer than four active individuals during a calendar month may be exempt. However, it’s important for companies to check the specific requirements with the Swedish Tax Agency, as exemptions can vary depending on specific circumstances.

The Swedish Tax Agency’S Role

The Swedish Tax Agency is responsible for monitoring and ensuring that companies comply with the staff ledger law. Through regular inspections, the Agency ensures that companies maintain their staff ledgers correctly. If companies fail to meet the requirements, they may face fines and other sanctions.

One way to ensure your company complies with all the rules is to use a digital staff ledger. With Nuba, businesses can feel confident that all regulations are followed, that the systems update as laws and regulations are introduced and amended, and that information is easy to retrieve.

Nuba’s electronic staff ledger makes it easy to keep all information up to date and ready for inspection. We also help businesses register their operations correctly and keep all necessary information available.

The Benefits of Using Nuba

By using Nuba’s electronic staff ledger, companies can benefit from several advantages:

Efficient administration: Reduce the time spent manually keeping a staff ledger and minimize the risk of errors.

Easy reporting and registration: Nuba makes it simple to register and keep track of everyone active in the company.

Increased reliability: Electronic registration ensures all information is accurate and updated in real time.

Legal compliance: Companies can be confident they meet all legal rules and requirements, reducing the risk of sanctions.