Not having a staff ledger available during an inspection can result in inspection fees and sanctions.

This applies to industries that are specifically required to keep a staff ledger, including construction, laundry services, and restaurants. These sectors are considered more exposed to undeclared work, and the Swedish Tax Agency’s inspections are intended to combat this.

One of the most immediate consequences of not having a staff ledger, or if the ledger is not maintained correctly, is that the company may be charged an inspection fee. Such a fee can amount to SEK 12,500 for each occasion when the staff ledger is unavailable or incorrect. If, in addition, information about an individual person is missing, an additional fee of SEK 2,500 per person can be added. This means fines can quickly become very high, especially if several people are not registered correctly.

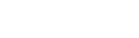

By keeping the staff ledger in Nuba’s digital app you won’t have to worry about reprimands. Everything is recorded quickly and smoothly, and all data is easily accessible if the Swedish Tax Agency conducts an inspection.

Obligation to Keep a Staff Ledger

Industries that are obligated to keep a staff ledger include construction, restaurants, hairdressing, body and beauty care, laundry services, and vehicle service. On construction sites, special rules apply regarding staff ledgers.

Companies in the construction industry have a clear obligation to keep a staff ledger for everyone working on their construction sites. This applies not only to employees but also to

The developer or the party conducting the construction work is responsible for ensuring the staff ledger is kept correctly. This means the ledger must be updated daily and contain all necessary information. If the Swedish Tax Agency conducts an inspection and finds that the ledger is missing or not kept correctly, this can lead to immediate penalties.

It’s also important to know that even if the company has a staff ledger, it must be easily accessible and presentable during an inspection. This means that if the Swedish Tax Agency arrives unannounced, the ledger must be produced without delay. Failure to do so can also result in fines and other sanctions.

The Swedish Tax Agency Conducts Visits

The Swedish Tax Agency has the right to carry out unannounced visits to construction sites to verify compliance with the staff ledger law. During these inspections, they will review the ledger and ensure that everyone working on site is properly registered. If there are deficiencies in how the ledger is kept, or if it is missing entirely, the Tax Agency can, as noted, issue inspection fees on the spot.

The standard inspection fee of SEK 12,500 applies for not keeping a staff ledger correctly. If there are additional issues, such as missing individuals in the ledger, SEK 2,500 per person may be added. These fees are intended to ensure that companies in the construction industry follow the rules and keep their worksites compliant.

It’s also worth noting that the Swedish Tax Agency can conduct follow-up visits if shortcomings are discovered during the first visit. If the company has not remedied the identified issues by a later visit, this can lead to even higher fines and, in some cases, legal action.

Simplify with an Electronic Staff Ledger

To avoid problems arising from poor handling of staff ledgers, many companies in the construction industry have chosen to use an electronic staff ledger. An electronic ledger simplifies the process by automating the recording of attendance and absence. This reduces the risk of human error and makes it easier to keep the ledger updated and accurate.

A digital staff ledger from Nuba streamlines your daily work and can be used both as documentation for the Swedish Tax Agency and for payroll, workforce planning, and reducing payroll administration costs.

Nuba’s electronic staff ledger can also integrate with other systems used on construction sites, among others, enabling more efficient site administration. By using an electronic staff ledger, you ensure all required information is available to the Swedish Tax Agency during an inspection, which can reduce the risk of fines and other sanctions.

In addition, an electronic staff ledger saves time and resources by simplifying the process of recording and monitoring attendance at the worksite. This is especially important for larger construction sites with many people working, where it can otherwise be difficult to keep track of everyone present.