Who Can Inspect the Staff Ledger?

In certain industries, staff ledgers are inspected by the Swedish Tax Agency. This mainly applies to sectors where undeclared work occurs, including the construction, beauty, and restaurant industries.

The Swedish Tax Agency’s inspections aim to combat undeclared work, safeguard the working environment, and ensure that employers follow the established rules on taxes and employment conditions.

In addition to the Swedish Tax Agency, the developer or the party responsible for the construction work may also check the staff ledger to ensure that contractors and others working on the construction site follow the rules. This is an important part of their obligations to make sure the site meets statutory requirements.

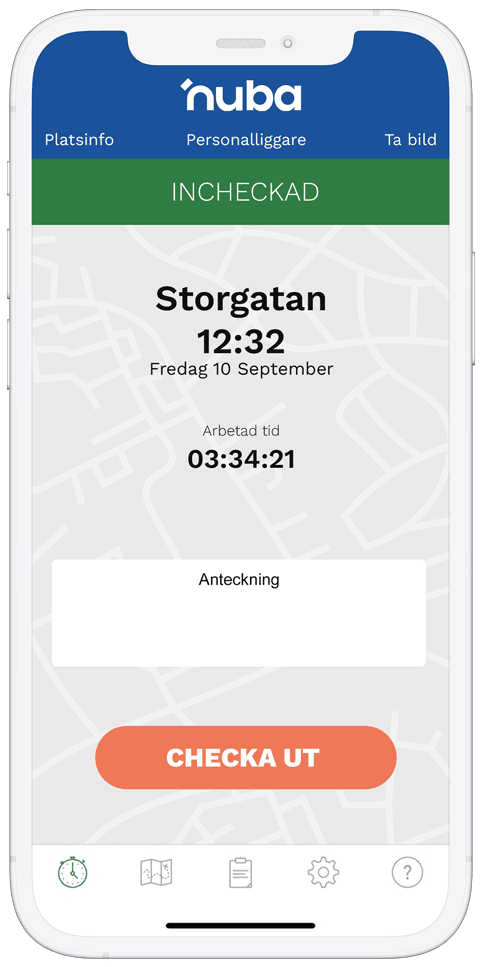

When the staff ledger is inspected, it’s important that it contains all relevant information, that is, who is working on site and the times the work was performed. By keeping a digital staff ledger with Nuba, you have easy access to all relevant information if an unannounced inspection takes place.

The Swedish Tax Agency is Authorized to Carry out Inspections

The Swedish Tax Agency has a clear mandate to check staff ledgers and conduct unannounced inspections at workplaces. These inspections aim to ensure that employers comply with the law by properly maintaining the staff ledger and registering everyone working at the site. By law, the staff ledger must be available to the Swedish Tax Agency during such an inspection, and the required information must be up to date and accurate.

The Swedish Tax Agency can issue fines if the staff ledger is not kept correctly, if information is missing, or if people working at the site are not properly registered. This makes it crucial for companies in the construction industry to have procedures in place to maintain the staff ledger correctly and ensure that everyone working on site is registered. This applies to all construction sites covered by the staff ledger requirement, and non-compliance can lead to significant penalties.

The Staff Ledger Must be Available at the Construction Site

To ensure inspections can be carried out efficiently, the staff ledger must be available at the construction site, and at other designated workplaces, at all times when work is in progress. This means both physical and electronic staff ledgers must be presented immediately during an inspection. The developer or contractor is responsible for ensuring that the staff ledger is up to date and that everyone working on site is properly registered.

Keeping the staff ledger correctly means recording each person’s presence and absence daily. The data must be saved and be available to report to the Swedish Tax Agency when needed. This is not only a legal requirement, but also a way for companies to keep track of who is on site and when, which can be important for both safety and planning.

Simplify with an Electronic Staff Ledger

Given the requirements to keep the staff ledger correctly and up to date, many companies in the construction industry have chosen to use electronic staff ledgers, like the one available through Nuba. An electronic staff ledger can streamline the process by automating the recording of attendance and absence and ensuring that all information is available in real time.

Nuba’s electronic staff ledger also offers the advantage that the information is more accessible and can be kept up to date with less manual work compared with a traditional paper-based staff ledger. This means that when the Swedish Tax Agency conducts an inspection, companies can quickly and easily present the necessary information without worrying that something has been forgotten or recorded incorrectly.

Another advantage of using an electronic staff ledger is that it can be integrated with other systems used on the construction site, providing an overview of all activities and resources. This can help improve planning and efficiency in the construction project while ensuring the company meets all legal requirements.

Summary

In summary, it is primarily the Swedish Tax Agency that has the right to inspect staff ledgers and carry out inspections at construction sites. To ensure that all legal requirements are met, the staff ledger must always be available at the workplace and be continuously updated. Electronic staff ledgers can simplify this process and ensure that all information is accurate and easily accessible during an inspection. By keeping the staff ledger in order, companies in the construction industry and other sectors can avoid sanctions and ensure they comply with all relevant rules and regulations.