A staff ledger is a list of which people work at a workplace, both hired personnel and regular staff. The staff ledger must, by law, be maintained as a way to ensure that employers follow laws and regulations regarding workforce, as well as taxation. The Tax Agency also uses companies’ staff ledgers as a measure against undeclared work and unfair conditions.

Generally, the following industries need to have staff ledgers:

The construction industry, restaurant industry, hairdressing and beauty industry, laundry industry, vehicle service, and food industry.

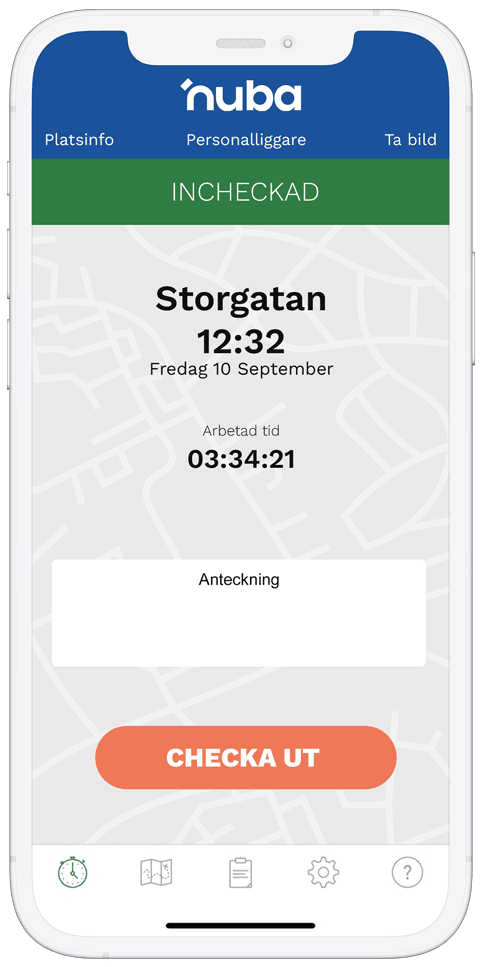

Nuba offers a convenient staff ledger in app where all necessary information is registered.

How Do Staff Ledgers Work?

Staff ledgers function as a logbook where all personnel are registered when they start and end their work shifts. It can be maintained manually or electronically. A manual staff ledger means writing in the information by hand, which can be time-consuming and more prone to errors. An electronic staff ledger, on the other hand, makes it possible to register personnel attendance digitally, which reduces the risk of errors and saves time.

The staff ledger must contain information about each person’s name, personal identification number, and working hours. This record must be available at the workplace and be able to be shown during a potential inspection by the Tax Agency.

Who Must Maintain Staff Ledgers?

Certain industries must by law maintain staff ledgers. This requirement primarily applies to the construction industry, but other industries such as body and beauty care as well as the food industry are also covered by the regulations. All companies that operate within these industries must have a staff ledger. For construction sites, the staff ledger must be maintained at the construction site from the first day when work begins.

Nuba Offers an Electronic Staff Ledger

Nuba offers a modern solution for companies that need to maintain staff ledgers according to law. An electronic staff ledger from Nuba provides a number of advantages compared to the traditional, manual variant. With Nuba’s solution, personnel attendance is registered digitally, which means less administrative work and fewer risks of misregistrations.

The Advantages of Nuba’s Electronic Staff Ledger

Using Nuba’s electronic staff ledger means not only following the law, but also doing so in a more efficient way. Here are some of the advantages:

-

Automated registration: Personnel check-in and check-out happens automatically, which reduces the risk of errors and saves time.

-

Easily accessible information: All information about personnel working hours is easily accessible and can be easily checked during an inspection by the Tax Agency.

-

Secure storage: The data is stored securely and is protected against unauthorized access.

-

Efficient administration: With an electronic staff ledger, the administrative burden is reduced, which frees up time for other important work tasks.

Why are Staff Ledgers Important?

Maintaining staff ledgers is a legal requirement for certain types of operations. The reason it is a legal requirement is to ensure correct and fair working conditions, where employees have the right to certain rest, certain weekly rest, pension, and other benefits. In certain operations, such as construction activities, there has been a lot of undeclared work where employees do not possess the rights they should have according to law.

The Tax Agency’s Role in Controlling Staff Ledgers

The Tax Agency has a central role when it comes to checking that companies maintain staff ledgers according to law. During an inspection, the Tax Agency can require to see the staff ledger to ensure that all information is correctly registered. If the staff ledger is not correctly maintained, the company can receive fines and other penalties.

Maintaining a correct staff ledger is therefore not only a matter of following the law, but also about avoiding potential problems and fines. By using Nuba’s electronic staff ledger, companies can be sure that they meet all requirements and that their personnel registration occurs in a correct and efficient way.

In summary, staff ledgers are a necessary tool to ensure that companies follow laws and regulations regarding workforce and taxation. With Nuba’s electronic staff ledger, companies can easily and efficiently meet these requirements, while reducing the administrative burden and ensuring correct and transparent personnel registration.