All persons who perform work in a business must register in the staff ledger, including those who are not employees but also work experience students from elementary school and owners.

According to the Swedish Tax Agency’s rules, certain industries are required to maintain staff ledgers to combat undeclared work. It is a way to regulate working conditions for workers.

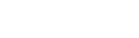

With Nuba, you get a convenient staff ledger that keeps track of all rules and laws for you, and is easily accessible in case the Swedish Tax Agency comes to the business for an inspection. Nuba offers staff ledger in app, via SMS, NFC tag, or automatic check-in.

What is Recorded in the Staff Ledger?

The following information must be recorded in the staff ledger: name and personal identification number of the person performing the work, when the work shift starts and ends, and the date of the work shift. This information is necessary for the tax agency to verify that the business complies with the law. The information must be accurate and updated in real time for the staff ledger to be valid.

Who is Required to Maintain a Staff Ledger?

In certain industries, there are requirements to maintain staff ledgers according to the Swedish Tax Agency’s rules, specifically in industries where undeclared work often occurs.

These are:

-

Construction industry

-

Restaurant industry

-

Laundry and cleaning companies

-

Hair and beauty industry

-

Body and beauty care industry

-

Auto repair shops and car care

-

Trade in used goods

-

Food production

It is the company’s responsibility to maintain a staff ledger. This means that the business owner or responsible person must ensure that all active persons are correctly recorded. If this does not happen, the company may face fines.

Answers to Frequently Asked Questions

What Happens if the Staff Ledger is not Correctly Updated?

If the staff ledger is not correctly updated or if it is missing, the tax agency can issue fines. This applies even if only one person is not correctly registered. The company can then receive fines of 12,500 kronor plus 2,500 kronor per missing person.

By using Nuba’s app, the information is constantly updated and it is easy to add new people to the staff ledger.

Must the Staff Ledger be Available to the Tax Agency?

Yes, the staff ledger must always be available to the tax agency during an inspection. It is therefore important that it is maintained carefully and that the information is current and correct. The tax agency can conduct unannounced inspections to ensure that the rules are followed.

In Nuba’s app, you have all the information you need just a few clicks away, and can quickly access it if the Tax Agency conducts an inspection.

Can You Use an Electronic Staff Ledger?

Yes, you can use an electronic staff ledger. Nuba’s electronic staff ledger is an excellent tool for easily and conveniently keeping track of staff working hours and ensuring that all information is correctly recorded. Electronic staff ledgers also make it easier to transfer information to the tax agency when needed.

Who Needs to Register in the Staff Ledger?

Everyone who performs work in the business must register in the staff ledger. This applies to both employees and others who are active on site, such as work experience students, spouse, and children under 16 years old. It is important to remember that people from other companies who work in the business must also be registered.

The Importance of a Correctly Maintained Staff Ledger

Maintaining a correct staff ledger is crucial for following the tax agency’s rules and avoiding fines. It also helps the company have a clear picture of who is active on site at different times. With Nuba’s staff ledger, companies can be confident that they have a reliable solution that meets all requirements and makes it easy to keep track of staff working hours.

By using a staff ledger from Nuba, it is ensured that the business follows the law and that all information is easily accessible and correct. This facilitates not only the company’s internal organization, but also any inspections from the tax agency.