What Happens if You Don’T Have a Staff Ledger?

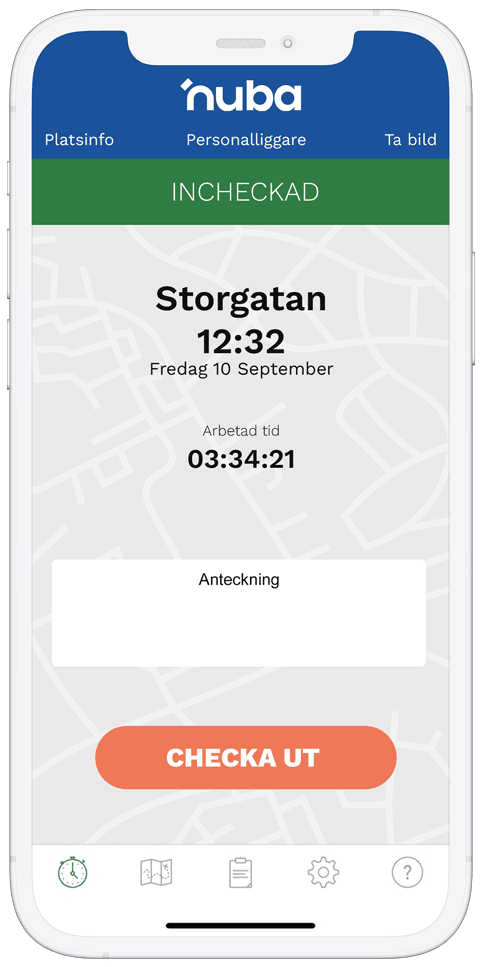

Not having a staff ledger available during an inspection can result in inspection fees and sanctions. This applies to industries that are specifically required to keep a staff ledger, including construction, laundry services, and restaurants. These sectors are considered more exposed to undeclared work, and the Swedish Tax Agency’s inspections are intended to combat this. […]

What Happens if You Don’T Have a Staff Ledger? Read More »